Ways to bank safely

You always need to be on your guard when it comes to banking and money. Maintain a healthy scepticism towards individuals or companies advertising online or who call you or contact you via email or on a social media platform. We recommend you take the following precautions:

- Never disclose PINs or passwords or save them in any way – including in your internet browser settings or in disguise.

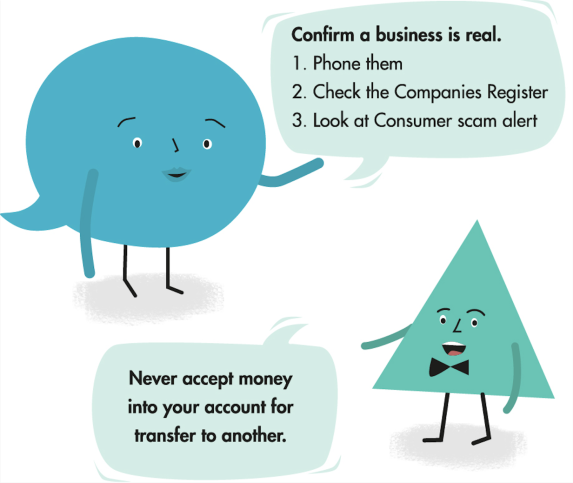

- Check who you are paying to ensure they are genuine before sending funds.

- Check with someone independent and trustworthy before you commit to anything.

- Never accept money into your account for subsequent transfer to others.

- Never give someone you do not know or trust remote access to your computer or devices.

- Check your accounts regularly to ensure money is going to the right places.

- Contact your bank immediately if you suspect you have been scammed.

In this guide, we explain some common scams. For more information, see also:

- our guide on how we assess scam complaints

- Commission for Financial Capability’s Little Book of Scams for types of scams

- our scam prevention tip sheet, which has lots of information to help you steer clear of current common scams.

When scammers trick you into sending money

Scammers can trick you into sending money to them in various ways. A common way is to offer investment services that may not deliver expected returns or may be a sham. Another is for an online friend to seek financial help. Losses from such scams can run into tens – or sometimes even hundreds – of thousands of dollars.

Always be careful if someone you don’t know or have met only online asks for money. It can seldom be recovered. It is your responsibility to ensure the legitimacy of the person you are sending funds to.

Online purchase scams

Online purchases are a convenient way to shop, but this convenience comes with a degree of risk because it can be difficult to determine the identity and genuineness of the person you are dealing with. Some scams involve online sales in which the seller has no intention of ever providing the service or goods, or the buyer signs up for a small fee only to find later charges of significant amounts.

If you have bought an item through a website with a debit or credit card, but the item does not arrive or the service was not what you agreed to, speak to your bank about the possibility of “charging back” the transaction. See our quick guide on chargebacks for more information about this process.

Be careful when arranging private sales online with people you don’t know, such as through trading sites or social media. If a private sale turns sour but you paid through internet banking, it may be very difficult to recover the payment.

Fake cryptocurrency, foreign exchange investments

The popularity of cryptocurrency and foreign exchange trading and investments has led to numerous fake online investments. These are often advertised on social media – and sometimes with trusted New Zealand personalities purporting to endorse them. These services operate almost exclusively online, making it hard to differentiate between legitimate and scam services.

These scams typically involve transferring funds to an online platform to trade in currencies or stocks. However, online trading of this nature can be high risk and you can lose all invested funds. In some cases, the platform itself may be fake and you may be shown false trading records to prevent you from realising your funds have been stolen.

Research the company or individual you are dealing with first. Do an internet search, look for reviews, ask for a physical address you can check, and look up the company on the Companies Register. You can check whether it appears on the Financial Market Authority’s scam warning page, and read its advice on how to protect yourself from being scammed. We also suggest seeking advice from an authorised financial adviser before making any significant investment.

Romance scams

With online dating commonplace these days, scammers may seek to befriend or romance you. Once the relationship is established, the online friend may tell you an unforeseen event or tragedy has happened and he or she needs financial assistance, or needs funds to travel to see you.

Victims of this scam are often older, have less experience with using the internet, but have significant savings, which a scammer can quickly drain. Victims may be emotionally involved with their scammer, making it challenging to break the spell.

Invoice scams

In this type of scam, a scammer hacks the email account of a legitimate company and alters invoices to request clients pay funds to a different account. Since the email and invoice look legitimate, these scams are hard to spot but checks can reveal them.

If you receive a request to pay a new or different account, we recommend you confirm the payment details using another form of communication (such as by phone). You may not be communicating with the person you imagine via email and a quick phone call can foil such deception.

Banks provide a confirmation of payee service for domestic payments made online. This will tell you whether the account name and number you are paying are a match. Be suspicious if the account name is different from the one you expected or is not a match.

Recovery room scams

Recovery room scammers target you if you have already lost funds in a scam, whether their own scam or another fraudster’s scam. They contact you and pretend they can help you – for a fee – to get back the money you lost. They seldom explain how they will recover the money, they generally ask for their fee upfront, often by credit card, and they can end up debiting very significant amounts to your card.

Once you pay upfront fees to a recovery room scammer, you are unlikely to get any money back from the previous scam and you won’t hear from the scammer again. Getting any money back from either scam can be very difficult.

If you’ve been a victim of a scam, be very careful about paying someone to help you get your money back. The person may not be genuine, and you may well be at risk of further losses. Instead, talk to your bank, the police or us – for free.

See our quick guide on recovery room scams for full details.

When scammers gain access to your accounts

Scammers also try to trick you into giving out personal information such as bank account numbers, passwords and credit card numbers, or giving access to your computer or mobile phone. This type of scam often takes the form of contact from what appears to be a company you have a relationship with, such as an email from your bank or a call from your telecommunications provider. Professional scammers aren’t the only ones to try to gain unauthorised access to bank accounts. Sometimes people known to victims impersonate them to gain access to their bank accounts.

Under the Code of Banking Practice, banks agree to reimburse fraud losses if your card or electronic banking was used without your authority and you:

- weren’t dishonest or negligent

- took reasonable steps to protect your banking, and

- cooperated and responded quickly to the bank’s requests for information.

See more information in our guide on how we assess scam complaints.

Email scams

In this scam, victims will typically receive an email from what looks like their bank or other trusted organisation. It will contain a link to a website that looks like the organisation’s but is fake. After victims enter banking login details, scammers can steal personal information or access accounts to steal money.

Be extremely wary of emails that ask you to click on a link. Don’t click on links within any email if you have the slightest suspicion about its authenticity. If you need to go to the organisation’s website, type the address into your browser.

Remote access scams

Scammers may also make phone calls pretending to be your bank or other service provider or a government department. They may ask you to turn on your computer and download software. They will tell you the software is to help you, but the software gives them access to everything on your computer. A scammer who has gained access to your computer may be able to steal money from your bank accounts. Be very cautious about unsolicited phone calls, no matter how plausible the caller sounds.

Be alert to requests from service providers that fall outside the scope of the services they offer. For example, your telecommunications provider is not able to provide information about your banking security, so it will not ask you to log into your internet banking when offering you technical support. If someone asks you for remote access to your device, you should call the company back on its publicly listed number before continuing. If the company did not contact you, you should notify your bank immediately so it can check your accounts are secure.

Impersonation scams

The people you have relationships with – friends, family members, carers, employees – often have the means to potentially scam you. Such people can do this by stealing cards, overlooking PINs being entered (see our quick guide on cards and PINs) and using impersonation to reset internet and phone banking details. Take care when accessing your banking around others and check your bank accounts regularly. If you need help managing your banking, talk to your bank about what arrangements can be put in place – see our quick guide on access to banking for more information about banking support.

Money mule scams

Another scam is to ask people to accept and forward money stolen from another victim’s bank account. In this way, they become what is known as a “mule”. Scammers convince people there is a legitimate reason for the transfer, such as paying a fee associated with a job application or refunding an accidental overpayment from an online purchase.

Never accept funds to forward to another person.

If this happens to you and the money is found to have been stolen, a bank may reverse the payment into your account.

Additional resources

Our case notes about scam complaints we have investigated

consumerprotection.govt.nz/scams/scam-alerts

police.govt.nz/advice/email-and-internet-safety/internet-scams-spam-and-fraud

Assessing scam complaints

Scams are becoming more sophisticated, and anyone can be caught out. If you’ve been tricked into sending money or your bank account has been accessed without your permission, this guide explains what happens when you make a scam-related complaint to your bank, and how we assess those complaints.

What should you do first?

If you have been the victim of a scam, see these resources to find out where…

Recovery room scams

How it works

Recovery room scammers target people who have already been the victim of a scam, whether their own scam or another fraudster’s scam. They contact victims and pretend they can help them – for a fee – get back the money they lost in online investment and trading scams, such as binary options trading schemes, foreign exchange investments and crypto-currency investments. They seldom expl…

Updated December 2025